Product Meta Fields module

Learn how to use the Product MetaFields module.

The WooCommerce plugin includes theProductMetaFields under the Digital River tab. Use the following steps to configure the Product Meta Fields module:

When creating a product under Product Data, click the Digital River tab to access the product meta fields. See how to create a product for more information.

Enter the following information:

Country of Origin– Enter the Country of Origin for your product.

SKU Group: Enter the product's SKU group information. Digital River provides a SKU Group field to collect and store data related to your product SKUs. This data lets you correctly determine tax rates and fulfill needed merchant and seller of record responsibilities.

Tax Code: Enter the Tax code that applies to your product.

ECCN: Enter the ECCN that applies to your product, which completes the Classification number and Digital River’s Description and Notes. Pay attention to the Notes, as they may contain important information relevant to your ECCN. Contact your Digital River account representative if you do not find the ECCN applicable to your product.

Item Description (optional): Enter the tax descriptions. This description is required and used for landed cost classification. Use detailed descriptions such as "Children's winter boots with Velcro" rather than simply "Winter Boots."

Item Breadcrumb (optional): Enter your own breadcrumb information. Breadcrumbs are used and required for landed cost classification. Assigned product categories are used by default. Use the following format: "Clothing > Women's Clothing > Jeans > Bootcut Jeans.

HS Code (optional): Enter the HS Code that applies to your product. This field is only used if you are set up to provide to your shoppers. Contact your Digital River account representative if you want to enable landed costs.

Note: The SKU field under the Inventory tab is mandatory when creating a product.

Note: When configuring digital products, in addition to having the correct digital Tax Code or appropriate SKU Group ID, the product must also have the Virtual product type checkbox checked. This tells WooCommerce that Shipping is not involved for this product. A product not meeting the minimum requirements will still be saved in WooCommerce. However, it will not be synced to Digital River's systems. As a result, checkout will fail for shopper purchases containing this product.

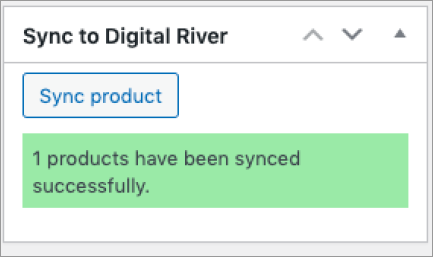

Once the product is published, it is auto-synced to Digital River. If the product sync fails, you can always resync from the product edit screen only. Clicking Sync Product syncs the product.

If you have enabled the plugin's Enhanced Currency Service feature, the Sync process will also update the local pricing for your products. This ensures that the prices displayed to shoppers are always the most up-to-date and accurately converted to the correct currency.

Using the "Sync Product" button, you can update local pricing per product. Alternatively, the "Sync Products" tool can be used to batch process all products in the system.

Important: If the product does not contain the required fields for SkuGroupID or ECCN+TaxCode, sync to Digital River will fail.

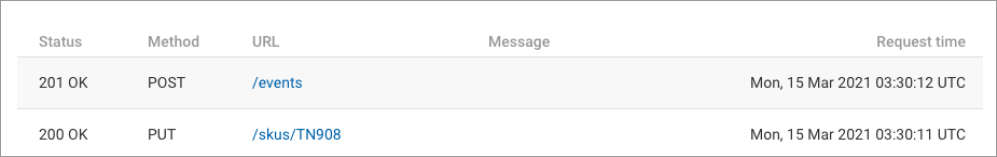

Once the product is synced, check under API logs in Digital River Dashboard. The log is identified by SKU for product sync.

Last updated