Checkout an order

Learn the details of the shopper checkout operation.

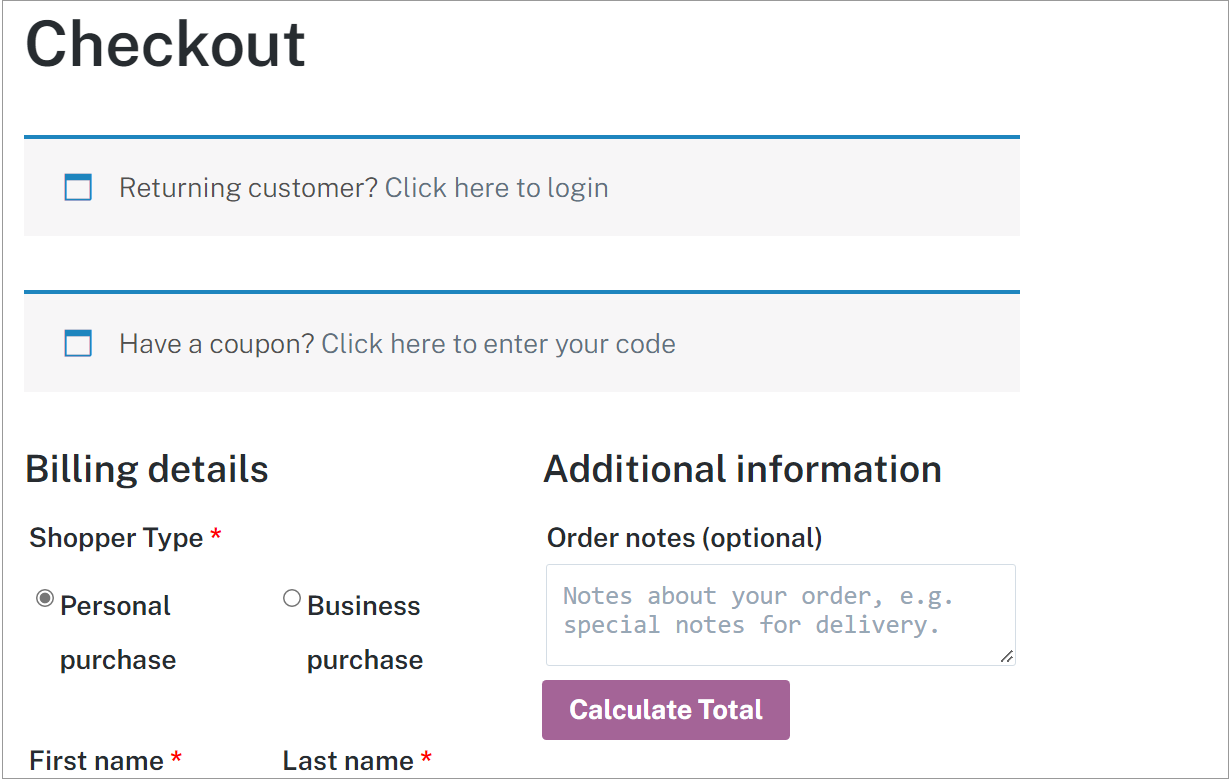

Once finished with adding products to the cart to create an order, a shopper proceeds to checkout. At this point in the order management flow, they are requested to fill in the billing and shipping information on the Checkout page.

In this process, the shopper needs to click Calculate Total to see the product total and payment methods. Also, every time the shopper changes anything in the order Address, Name, or any other field, they must click Calculate Total to see the changes.

The shopper can find this button in the Additional Information section to the right of the Billing Details section of the Checkout page.

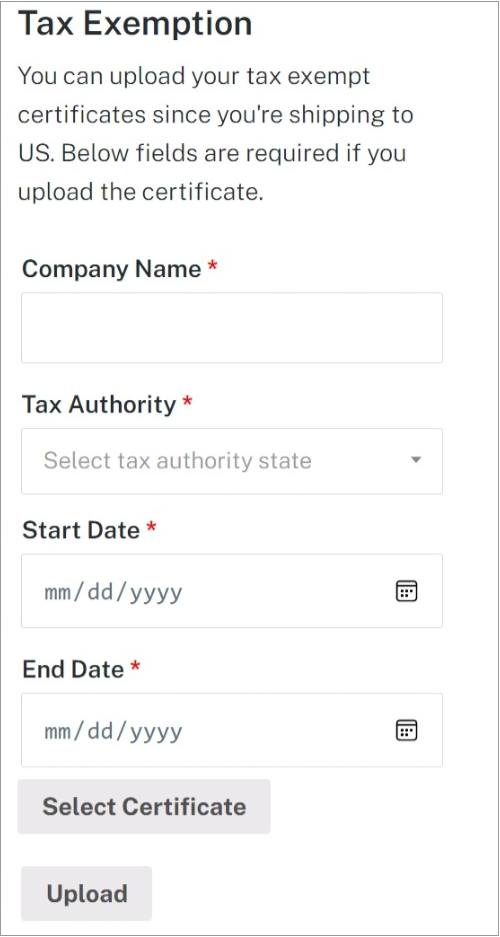

On the Checkout page, the shopper can opt for tax exemption based on the address provided in the Tax Exemption section underneath the Additional Information section.

If the address country is the United States, the shopper is prompted to upload their certificate.

Once the shopper places the order, the tax certificate is sent to Digital River for manual verification. Based on the verification results, the shopper is notified whether or not their tax exemption certificate is valid.

If the address country is other than the United States, the shopper will be asked to enter the VAT number. The Digital River platform will be called via API to verify the VAT number. Upon successful verification, the tax will be exempt for current and future purchases.

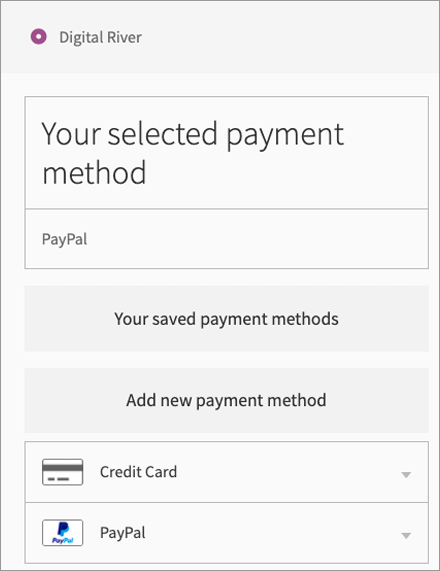

The payment options that appear on the Checkout page are based on the payment methods configured for the shopper's account within the Digital River Drop-in.

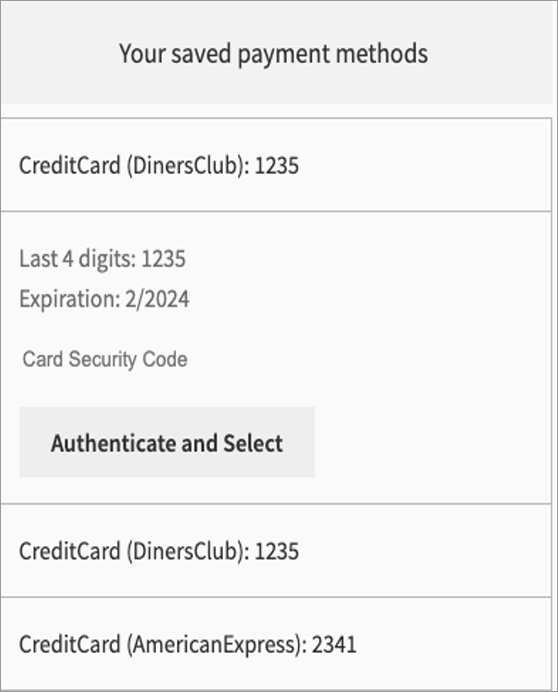

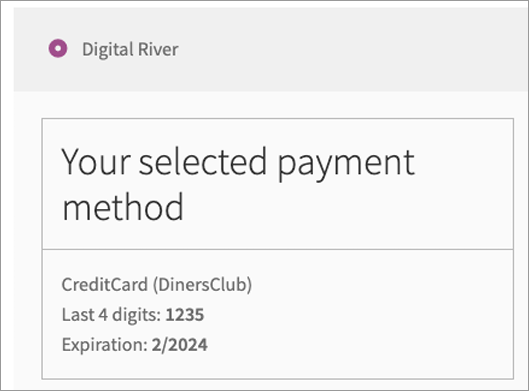

Clicking Your Saved Payment Methods will show all of the shopper's saved payment methods.

To select a payment method, the shopper clicks Authenticate and Select. The payment method will appear as the selected payment method.

To add a new payment method to the available payment methods, the shopper clicks Add new payment method, selects a payment method, and then clicks Place Order.

Note: The plugin currently does not support cart checkouts that result in zero amount total.

Last updated